Why is Private Equity Participating in Physician Practice Mergers and Acquisitions?

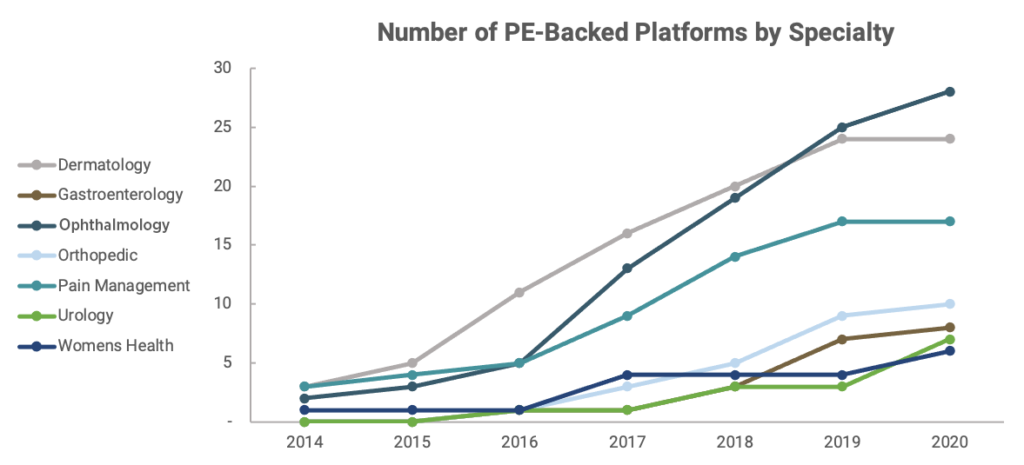

Private equity firms historically shied away from investing in single-specialty practices due to the complexity and regulation in the healthcare industry. However, the demonstrable success of early platforms laid the groundwork for sustainable investment in multi-site healthcare service organizations. Founded in 1997, Heartland Dental has grown to over 1,000 dental practices with the support of four separate private equity partners over the last 20 years, the most recent being KKR, one of the world’s largest private equity firms. In the last 5-10 years, there has been a significant uptick in physician practice M&A activity, with interest that has been validated by initial, successful case studies in Dermatology and Eye Care.

Forefront Dermatology is another example of how healthcare private equity can exponentially increase the growth of a physician practice. Founded in 2001, the platform was created through an initial investment from Varsity Healthcare Partners in May 2014. At the time, Forefront operated 40 clinics across 4 states, primarily in the Midwest. In February 2016, after less than two years of ownership, the platform had grown to 80 clinics across 11 states in the Midwestern and Mid-Atlantic regions, allowing Varsity to sell the business to OMERS Private Equity and delivering a “second bite of the apple” to the physician shareholders. OMERS has further developed and scaled the platform to more than 130 clinics across 16 states.

Similar to Forefront, EyeCare Partners, headquartered in St. Louis, has been successful in growing and expanding within the physician practice management space. First acquired by FFL partners in 2015 with approximately 63 locations, EyeCare Partners quickly grew to 450 sites across 14 states. Partners Group recently purchased EyeCare Partners at a premium valuation (over $2.0bn) in 2019.

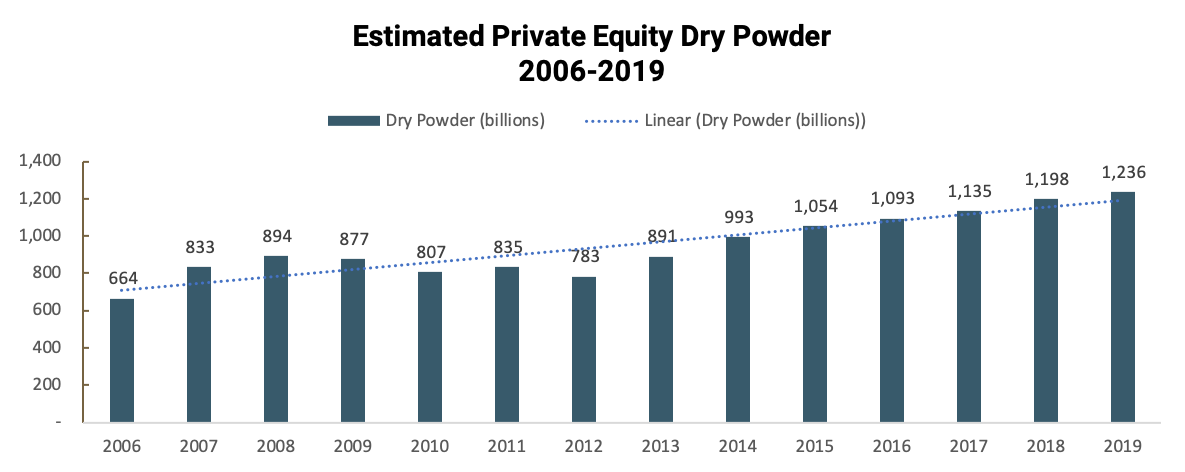

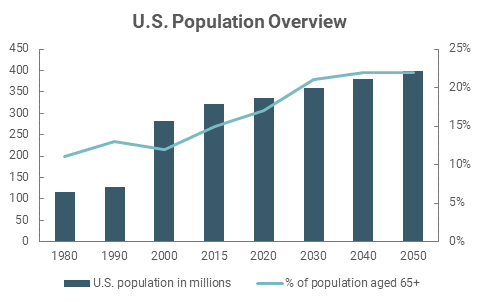

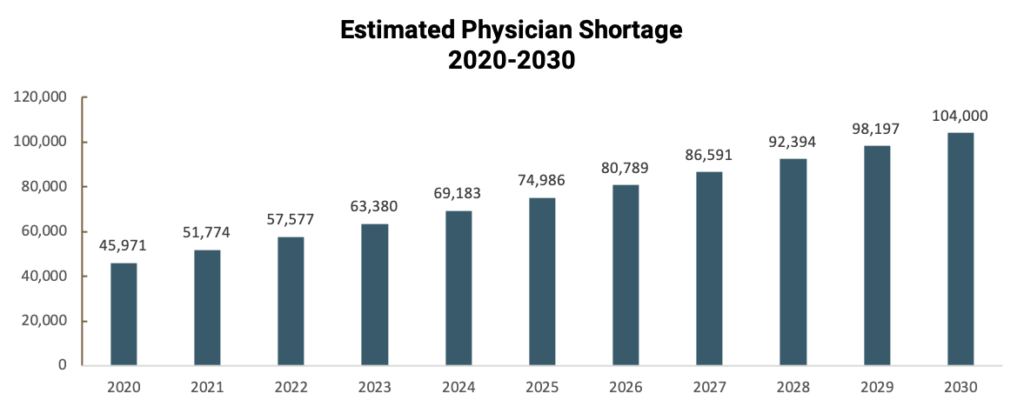

A private equity partner that is both an optimal cultural fit and offers a cohesive growth strategy enables a physician practice platform to scale significantly more rapidly than they otherwise could independently. Healthcare private equity groups typically look to scale physician practice platforms over a 5-7 year investment cycle before ultimately evaluating an exit, recognizing a healthy return on investment for all constituents. In particular, private equity investors in the healthcare space continue to be attracted to physician specialties that benefit from continued growth in the aging population, supply and demand imbalance, and increasing prevalence of chronic conditions. The supply of qualified healthcare providers currently lags behind the demand created by the aging US population, resulting in favorable macroeconomic conditions that support the deployment in capital towards such investments theses.

Click the images to expand the graphs below.