Private Equity and What It Means for Your Medical Practice – White Paper

Winter 2022

Why you need a knowledgeable transaction advisor in your corner

and how to choose the right one

The appetite of private equity (PE) investors for healthcare assets has continued to grow in recent years and shows no signs of slowing. According to a recent Bain Report on Global Healthcare PE investment, in 2021 the industry set new records for deal volume, deal size, and total dollars raised for future healthcare investment. And even though billion-dollar deals dominate the business press, private equity buyers are eager to acquire the consistent cash flow and growth potential that healthcare practices can provide, whether it be focused on urology, orthopedics, cardiology, gastroenterology, behavioral health, or any other healthcare provider. During the last decade, there has been a significant uptick in physician practice M&A activity, with interest that has been validated by successful forays into dental, dermatology, and eye care.

By now you’ve likely heard of peers or former colleagues receiving multi-million-dollar unsolicited offers from PE buyers – perhaps you’ve received one yourself – but the lure of a big payday can often obscure the many pitfalls and challenges that exist when considering such an important transaction. Getting private equity involved in your medical practice comes with plenty of questions. Is it better to sell to a private equity group or to an area hospital? Can you maintain operational independence after selling to a private equity group? What are the regulatory issues? How are these deals typically structured and what is fair compensation?

All these issues, and many more can overwhelm even the best run practice group. That is the reason that Michael Kroin and Ezra Simons founded Physician Growth Partners (PGP) in 2017 – to proactively advise and advocate for practice groups exploring a sale to healthcare private equity investors.

What to consider when choosing a transaction advisor?

Because private equity transactions often begin with a physician practice receiving an unsolicited offer, some may think that hiring a transaction advisor is unnecessary. Some may think, “I have an impressive offer in hand” and not believe they need assistance. Others may already have a relationship with the potential investor and say to themselves, “I can negotiate on my own and get a good deal.” Still another thought may be that the physician’s own lawyer or accountant can handle the transaction alone.

In fact, these beliefs can all lead to errors with potential far reaching consequences.

Just as you wouldn’t sell your house to the first person that knocks on your door and is willing to write a check, physician groups should never limit their negotiations to just one bidder, no matter how impressive the first offer is. In addition, few physician organizations have the necessary financial analysis, marketing, and negotiating expertise to tackle a private equity transaction without assistance.

For example, it is extremely important to understand the difference between EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) and multiples, as well as focusing on which offers more benefit to the selling physicians. When properly handled, a healthcare private equity consultation involves more than advisory work, but also considers financial engineering and the operational and administrative structure under which the selling physicians will work after the transaction is complete.

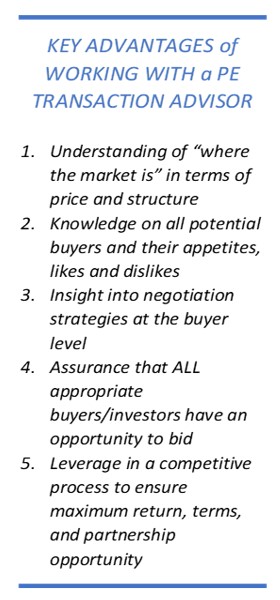

Because our team handles only transactions involving physician practices, each of our advisors understands how specialty medical practices work, know how to uncover appropriate market value, and can effectively communicate that value to a wide range of private equity bidders to achieve the best deal price AND terms. Here are just a few of the key considerations to keep in mind when choosing a transaction advisor:

- Relationships with and knowledge of potential private equity bidders

- Knowledge of and experience with your specialty practice

- Experience analyzing and presenting the financials of a practice like yours

- Skill to help you better understand the deal process and manage it effectively

- A track record of success for physician practices like yours

To demonstrate the depth of our knowledge and experience with specialty practices, let’s look at current US market approaches for private equity investment in physician practices.

The Private Equity Strategy

Private equity firms that are investing in healthcare, especially those focused on physician specialties, have adopted a “platform-based” strategy to organize and channel their approach. This means firms are making a large initial investment by acquiring a regionally dominant practice that is used as a platform upon which subsequent investments in smaller practices can be added. Using this model, firms may quickly establish multi-state and regional dominance, building scale while recognizing operational, technological, and marketing synergies driven by geographic proximity.

Another strategy that some investor groups take is to acquire strong, clinically driven practices in multiple areas, establishing a brand known for exceptional patient outcomes. Many physicians are worried that healthcare private equity investors will interfere with practice management, affecting patient experience while dictating to the physician how to practice medicine. Most private equity firms are aware of this risk, and instead aim to remain in the background, working to eliminate inefficiencies and drive growth, while preferring physicians to take leadership roles and be fully committed to patient care.

As such, healthcare private equity investors are looking for physicians that are strong leaders and have impeccable reputations. Cultural fit is one of the most underrated, yet important aspects of choosing a private equity partner in healthcare. To ensure the continued success of a physician practice, it is crucial that there is strategic alignment and mutual respect between the parties. This can best be accomplished by fully vetting all possible partnership opportunities.

Healthcare private equity groups typically look to scale the physician practice platforms they invest in over a 3-to-7-year period before ultimately evaluating an exit, securing a healthy return on investment for all involved. These exits often move the practice to a larger private equity investor or to a merger of similar platforms. They may also ultimately partner with an insurance payor, or even go public, but this has not taken place yet. Healthcare private equity investors focus on specialties that will benefit from continued growth in the aging population, supply & demand imbalance, and increasing prevalence of chronic conditions.

What is the benefit of working with Private Equity?

Selling to a reputable healthcare private equity firm can bring unique benefits to a physician practice. It often means doing away with or greatly reducing the administrative burden of the physicians, letting them focus more clearly on helping their patients. One of the most crucial changes made by many private equity investors is to establish a Management Service Organization structure to handle duties like operational and financial management, human resources and hiring, billing and collections. This innovation empowers the physician team to focus on patient care and gives them access to resources that they would not otherwise have. Healthcare private equity investment also provides the capital to accelerate the growth of the practice through acquisitions, de novo locations, expansions of service lines and upgrading equipment, which benefits the patient population.

The alternative of selling to a PE firm may be to consider a sale to a local hospital or regional healthcare provider. However, these transactions rarely deliver the independence, clinical autonomy, or the financial rewards that a private equity deal can offer. The sale price for a practice is often significantly higher when selling to a healthcare private equity group as opposed to a hospital system. Typically, a health system will simply offer to purchase a medical practice’s fixed assets plus negotiate long-term employment arrangements for the selling physicians. In contrast, PE groups can make a much more lucrative offer by applying a significant multiple of the practice’s earnings or EBITDA.

How can a transaction advisor help you?

Not all private equity firms conduct business the same way, and it is important to be comfortable with a firm’s approach to ensure the right cultural fit, since this will drive the remainder of a physician’s career.

There is much more to these transactions than pure economics, since the deal terms will guide the future of the practice operations and how the medical providers work and are compensated, what additional investment will take place, etc.

Physician Growth Partners’ advisory team assists clients to explore all viable options, while running a competitive process to achieve the most favorable outcome from the perspective of both economics and deal terms. PGP has extensive experience negotiating against most of the platforms that PE firms have established within each respective specialty, as well as the healthcare private equity groups driving these investments.

As a result, we can help physician groups develop a clear case that explains the practice’s appropriate value, markets the package to attract the best investment partners, and then evaluate the pros and cons of each potential deal before negotiating an excellent agreement that all parties are satisfied with.

About Physician Growth Partners

Physician Growth Partners is one of the most active national healthcare advisory firms dedicated to representing physician platforms in transactions with private equity. PGP creates value by providing operational support, strategic positioning, and transaction advisory, delivering an optimal outcome for its clients.