Orthopedic Private Equity – White Paper

Spring 2022

Within the landscape of healthcare investing, orthopedic specialty practices have seen amplified levels of interest from private equity investors within the past year. Despite this interest, compared to other specialties that are further along in the consolidation life cycle, orthopedic care has yet to experience large scale M&A efforts. Orthopedic transactions totaled 20 in 2021, following 5 in 2020 and 17 in 2019. Comparatively, specialties like dermatology and eye care have seen 25 and more than 95 transactions in 2021, respectively.

There are many parallels that can be drawn between orthopedics and other sub-specialties that have attracted private equity investment. One driver of consolidation across all physician practices is the experience that operational and cost synergies emerge with scale. With a sub-specialty as fragmented as orthopedics, private equity investors seek to add value by improving revenue cycle management, consolidating IT, and payroll, as well as adding ancillary services that smaller practices cannot support. These consolidated platforms are eventually striving to shift the tides in their favor through payor contracting as well.

Orthopedic Private Equity Landscape

Recent Orthopedic Private Equity Consolidation

Why Now?

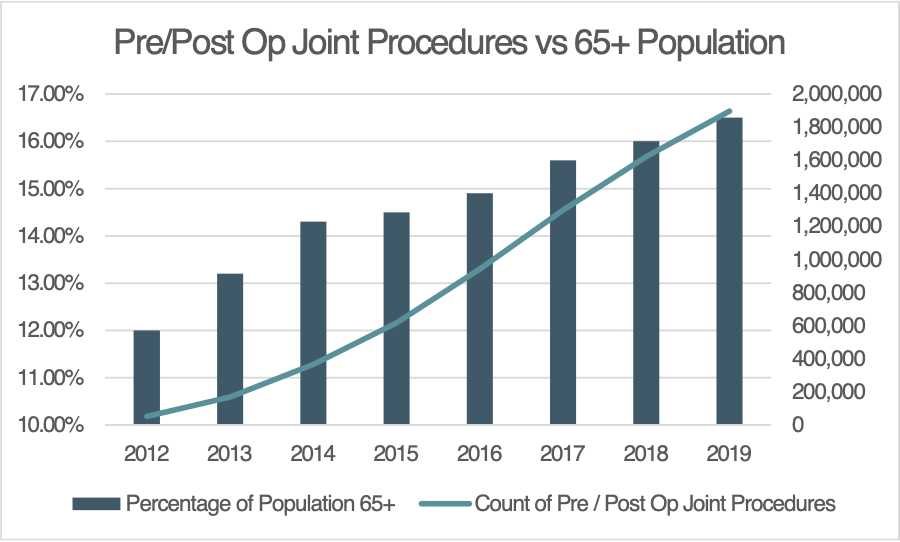

Orthopedics has always been an attractive specialty for private equity due to a multitude of factors, but now so more than ever. First, aging demographics in the United States continue to drive an increase in demand for services. As the U.S. population continues to age, joint replacements, spinal complications and related cases have continued to rise nationally. For example, the United States Joint Replacement Market size was estimated at $3.62 billion in 2021 and expected to reach $3.97 billion in 2022 and is projected to grow to reach $5.19 billion by 2027.

Additionally, orthopedic care remains one of the most fragmented subspecialties in healthcare. It is estimated that nearly 70% of orthopedic practices have fewer than 10 providers. Notably, there is a lack of established, scaled orthopedic platforms within major U.S. metro markets and the surrounding regions. Currently, 15 platform organizations exist, serving major markets in the Southwest, Southeast, Mid-Atlantic and Northeast. These facts coinciding with the ongoing push towards outpatient procedures that offer the same quality of care, affordability, and increased accessibility for patients has created an environment ripe for independent practices and private equity to take advantage of. That said, only recently has the attention from private equity in the space been so widely reciprocated by orthopedists.

With a plethora of service offerings, there are many opportunities for sustained growth among private equity backed orthopedic platforms. Physical therapy, pain management, sports medicine, DME programs and MRI/imaging present a variety of ways that platforms can create “one-stop-shop” opportunities for private practices seeking growth. Additional service lines such as orthopedic-focused urgent care, and surgery centers only increase the attractiveness of the specialty to the private equity investment community. The depth of the orthopedic service offering simultaneously creates a value proposition that private equity can offer orthopedists as well. The introduction, expansion, and enhancement of services private equity can support allows for greatly accelerated growth, and in turn, a benefit physician shareholders get to reap on an ongoing basis.

Looking at the broader picture and the recent increase in interest from independent orthopedists, activity is expected to rapidly accelerate in the next 5-7 years. This creates an attractive but narrowing window of opportunity for independent practices to become first movers and leaders within their geographic landscape.

The Private Equity Strategy

The overall drivers of private equity investment are similar between subspecialties – but the underlying strategies vary from group to group. A unique component of orthopedics, particularly when compared to other more established specialties such as ophthalmology or dermatology, is the focus on building regional (versus national) platforms. Groups are looking to enter markets with a scaled, clinically excellent provider, then building around them in that region. Whether it be through de novo or acquisitive growth or service line expansion, PE backers will use their resources to build density around a founding partner in each region. Each platform may have different preferences as to how they achieve economy of scale, but that will always be the ultimate goal.

When it comes to building an effective growth strategy, private equity platforms are seeking out physicians, experienced operators and industry veterans that are well versed in sourcing, evaluating, and eventually consummating partnership opportunities. By strategic planning, deploying ample capital and aligning providers, optimal outcomes can be achieved from both a clinical and financial standpoint. Private equity backers seek to achieve target ROI over an extended growth cycle that is typically 3 to 7 years, so operational shortcuts are not an option for investors. Maintaining quality care is at the forefront of each platform’s strategy, but it is always important to understand the underlying vision of each potential capital partner before entering a transaction.

Once a capital sponsor has completed its growth cycle, it will look to sell the platform to a new financial backer. This will occur in a variety of ways, including selling to another existing platform, a larger healthcare-focused fund, or by potentially going public. This sale is frequently referred to as a “second bite,” triggering a liquidity event for physicians to achieve a successful economic outcome or roll their equity over to the new platform sponsor. Orthopedics has yet to experience large scale “second bites,” proving that it is a specialty that has a substantial runway for growth.

How are Independent Physicians Affected?

One of the most pressing questions that comes from physicians interested in a partnership opportunity is how it will affect their practice and everyday operations. Private equity sponsors have become an attractive route for providers by alleviating the burden of balancing business development, administrative duties, and clinical care. Most platforms understand that partnerships are not ‘one size fits all’, and work to achieve the goals of providers in all aspects of the business. Whether physicians prefer to be hands-off or take part in strategic planning, there are platforms that offer a full range of options. Practices at the local level are most often encouraged to be as involved as possible to plan for target market entries and future service offerings.

As the state of the healthcare market has evolved, physicians have reacted to the macroeconomic shifts posing risks to their independent practices. COVID-19 presented the challenge of dealing with unprecedented business conditions while also seeking to deliver exceptional care. With a capital backer there is insulation from external forces, allowing providers to focus on quality outcomes for their patients. Moving forward, orthopedic practices will continue to join private equity platforms at an accelerating pace. It’s imperative to consider potential partners carefully to ensure there is an aligned vision of solutions that can be brought to each physician involved.

Driving Practice Value

While the starting point of establishing transaction value begins with financials, there are a multitude of factors both qualitative and quantitative in nature that influence purchase price. Market reputation, established operational infrastructure and attractive growth prospects can all raise valuations. Physician Growth Partners utilizes our team’s financial acumen and our market knowledge to accurately measure what buyers will give “credit” for. This ensures our client will achieve an optimal value.

With extensive experience negotiating opposite the PE buyer universe, PGP delivers results to all clients that exceed market expectations and go beyond what could be achieved on a standalone basis. An essential aspect of how we drive value lies in utilizing a competitive process. With a carefully curated set of prospective partners involved, we help clients understand how each option can help achieve the practice’s goals, both in the short and long term. Utilizing a healthcare transaction advisor like PGP gives physicians the ability to focus on clinical operations while an experienced, independent team crafts the optimal partnership strategy to achieve their goals.

What Happens After the Transaction?

Transacting with a private equity sponsor can seem like a daunting transition — in reality, physicians will largely continue to operate their practice in a “business as usual” manner. Sponsors will work to incorporate strategic growth plans, but in orthopedics, where much of the decision making is made at the local level, a great deal of autonomy remains. Operationally, platforms offer guidance to help practices enhance their workflow. All changes that occur should be additive in nature, not stripping away what has been built up since the inception of the practice.

Infrastructure will be bolstered, and back-office operations will likely be integrated into the platform to improve efficiency. On the clinical front, physicians will practice medicine the way they always have. Clinical autonomy is among the most important factors for physicians interested in a partnership, PGP emphasizes this and platforms understand its importance.

An additional relevant issue in orthopedics (but not all sub-specialties) is the ability to achieve “income repair” post-transaction. While a percentage of the physician’s historical compensation will be scraped to create EBITDA (which buyers will ultimately apply a multiple to), after the completion of the deal physician compensation generally remains untouched. Instead of moving to a compensation model based on a percentage of collections, as is done in ophthalmology and dermatology, orthopedics can continue distributing profits amongst the partners as they have done in the past. While this will result in reduced compensation at the outset, a successful partnership will lead to increasing profits allowing partners to get back to historical comp levels quickly and, potentially, achieve even greater levels down the line. This concept is very important to consider for tenured providers, but even more so for younger providers who may not view private equity favorably.

The last element of the transaction that is important to note is the equity that is rolled over into the new partnership by practice shareholders. Platforms expect that a percentage of the purchase price will be used for equity, but that percentage will change depending on the group as well as each shareholder physicians’ future goals. This is to maintain alignment with the overarching platform, and it allows shareholders to partake in the overall growth strategy of the private equity sponsor. A successful partnership will see shares appreciate until the 3 to 7-year growth cycle is completed, leading to the first liquidity event.

When considering a private equity partnership, the economics of the transaction become a moot point if the clinical and strategic fit is not right. In the current landscape of healthcare investment, doctors must continue to operate in an environment that leads to the highest quality outcomes for patients. Without this, a platform will struggle to find success in the long term. By developing a proper partnership plan, generating a sustainable and optimal growth strategy will come seamlessly with the right capital backer.

Physician Growth Partners is a firm that recognizes and prioritizes the importance of clinically focused outcomes, first and foremost. Groups that we have had the opportunity to advise will attest to the emphasis we place on prioritizing the partnership fit over the economics of a transaction.

To contact Physician Growth Partners about a potential relationship, please see below:

About Our Firm

Physician Growth Partners (PGP) is a transaction advisory firm that represents independent physician groups in transactions with private equity

Differentiated Healthcare Transaction Advisors:

- Senior partner involvement at every stage of the process

- Extensive physician practice transaction experience

- Unmatched relationships with all key private equity and strategic buyers interested in Orthopedics.

- Educational approach focusing on both partnership and cultural fit, while simultaneously achieving a market-clearing valuation